Remitap empowers global fintechs with a compliance‑first approach, supporting seamless onboarding, wallet creation, transaction monitoring, and cross‑border settlements. Built to meet the highest security and regulatory standards.

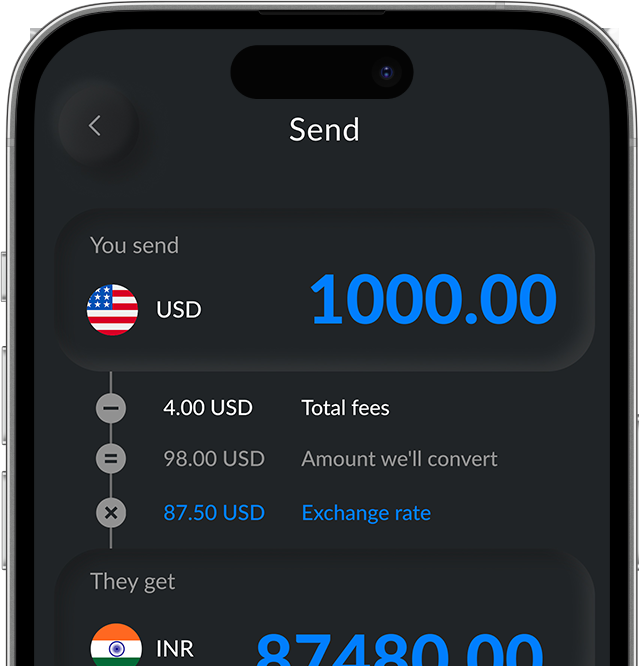

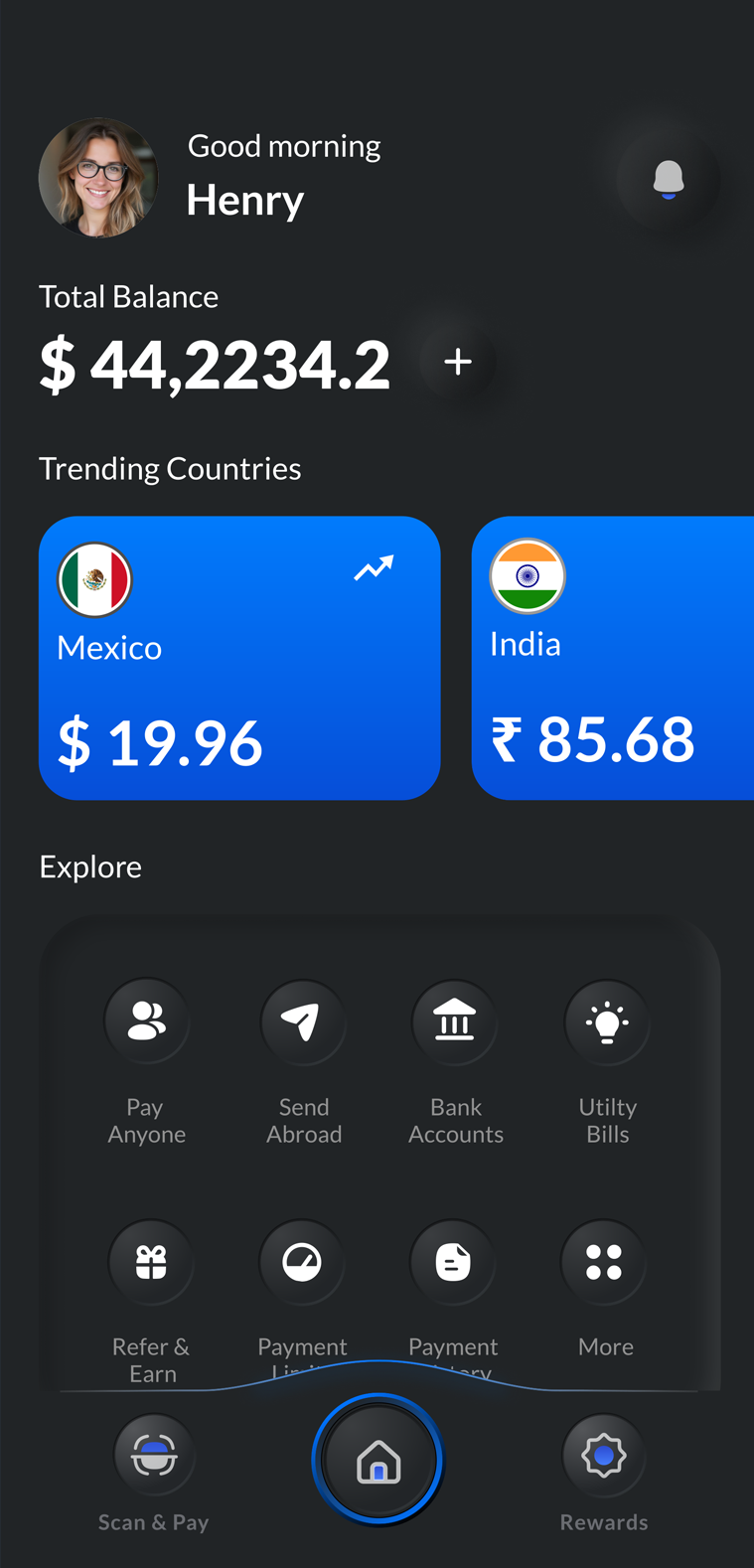

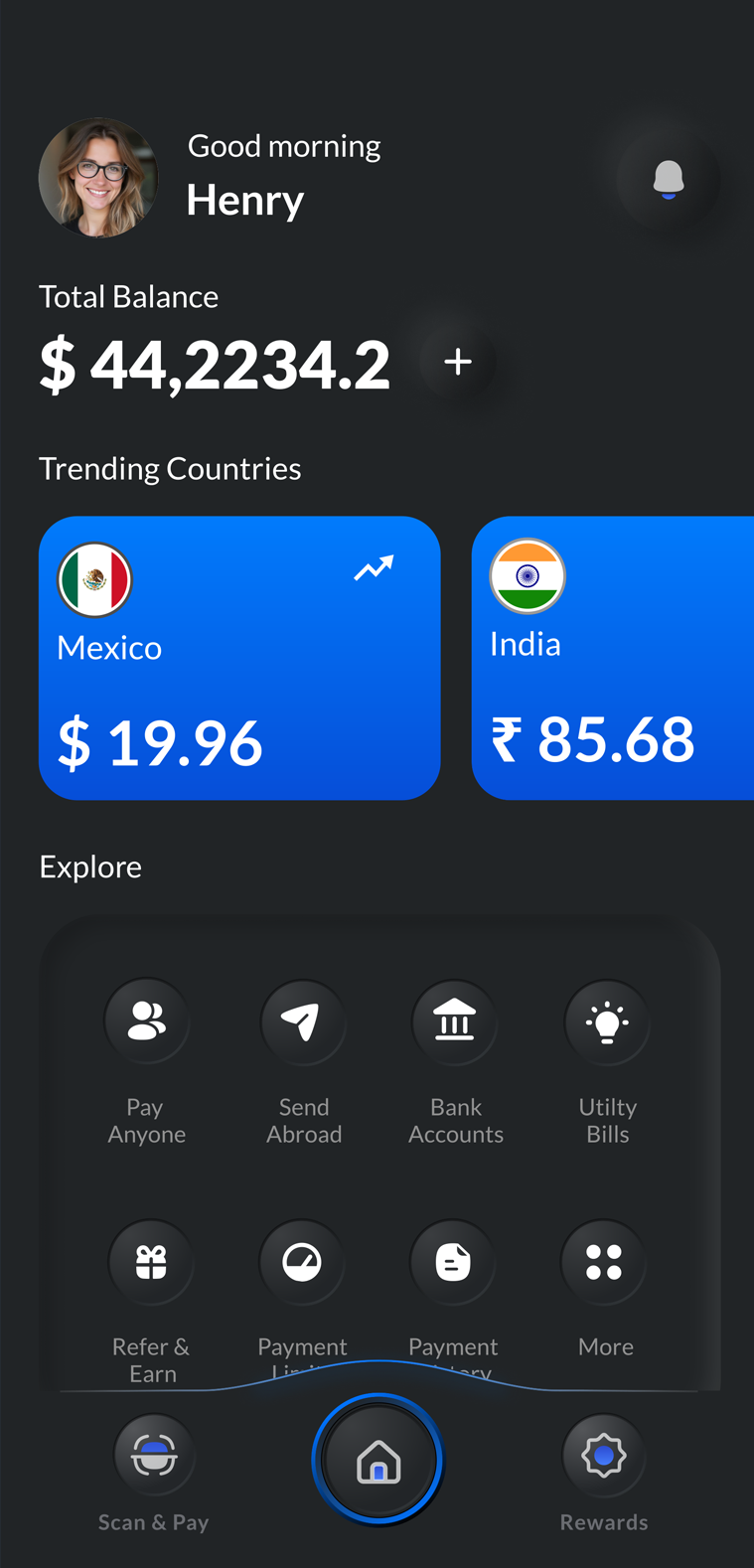

Send and receive money to wallet, bank and as cash pickup.

Transfer confidently using the most secure & advanced platform

Remitap provides a unified financial technology stack — from digital onboarding and compliance to payment orchestration and real-time reconciliation — helping businesses launch faster and expand globally.

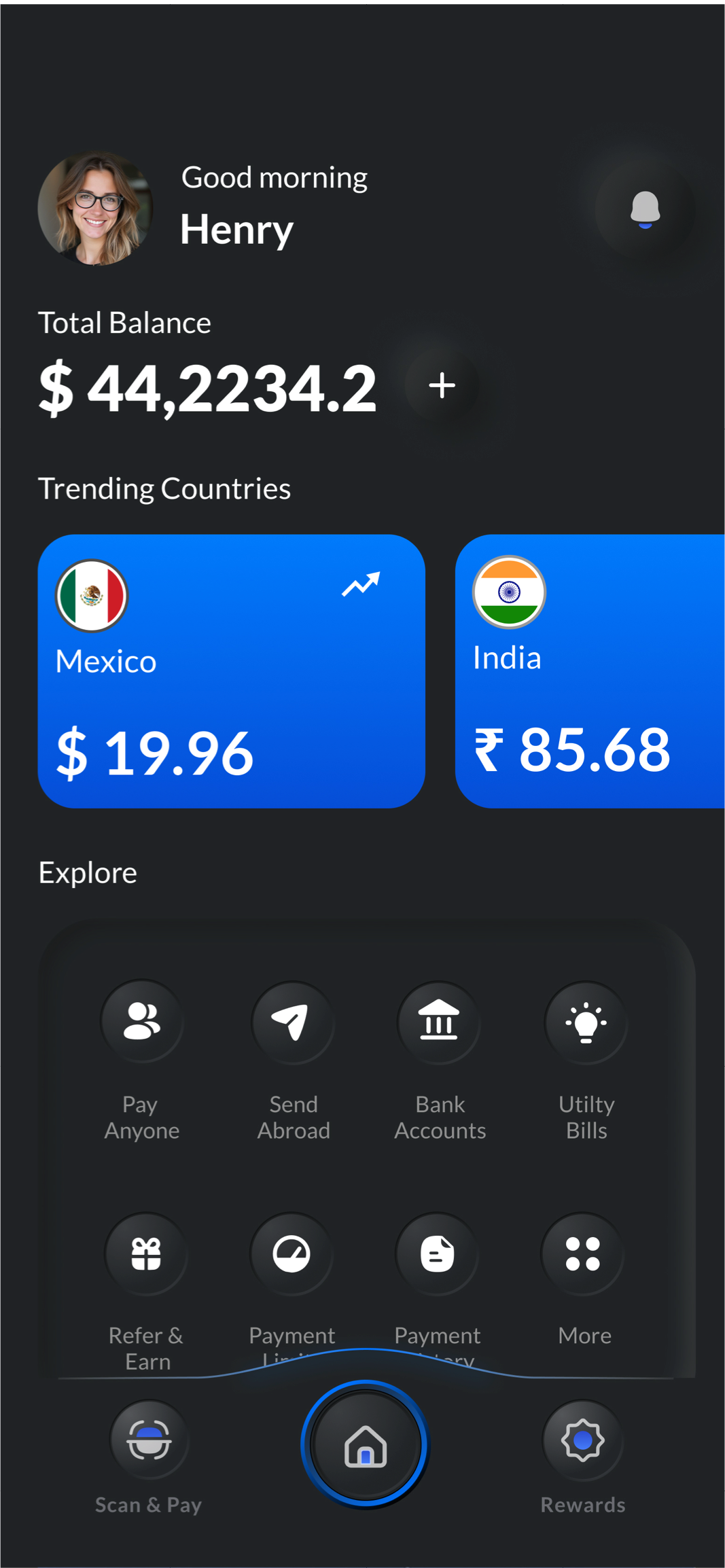

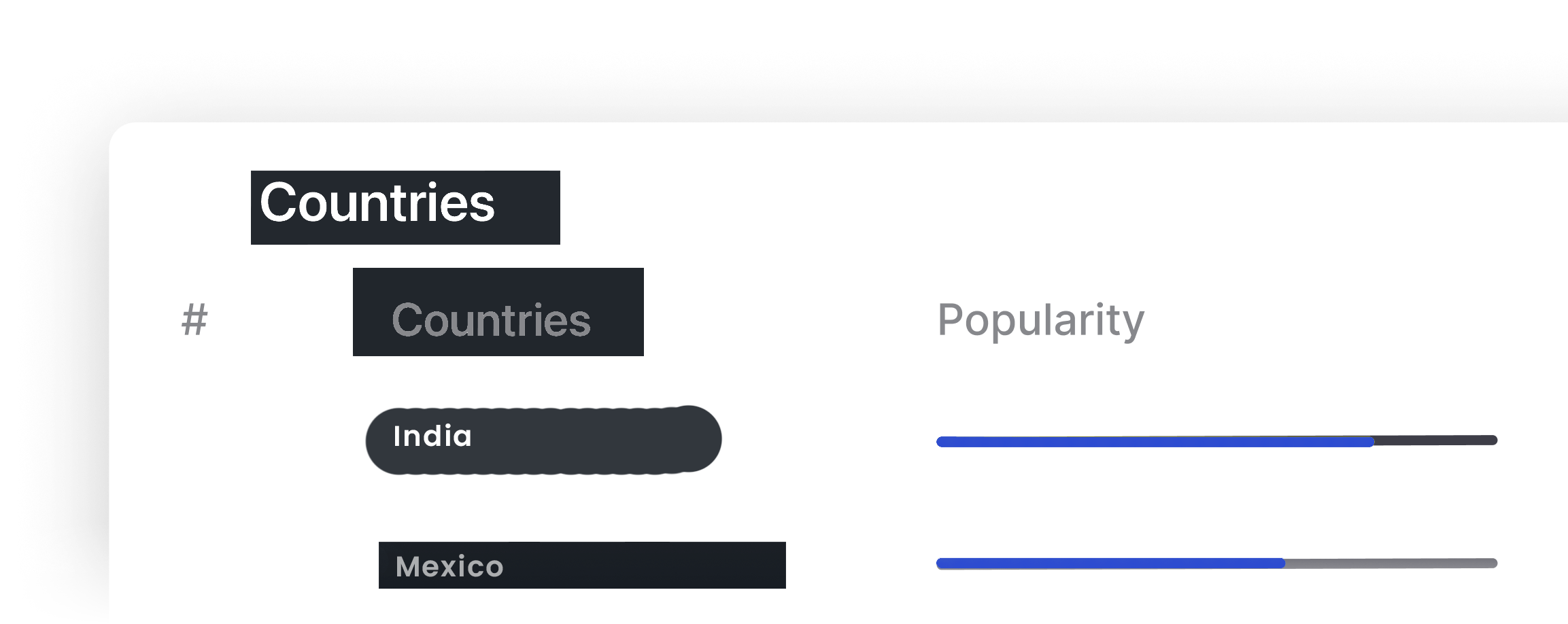

Monitor where your users send money the most.

Accessible across all devices.

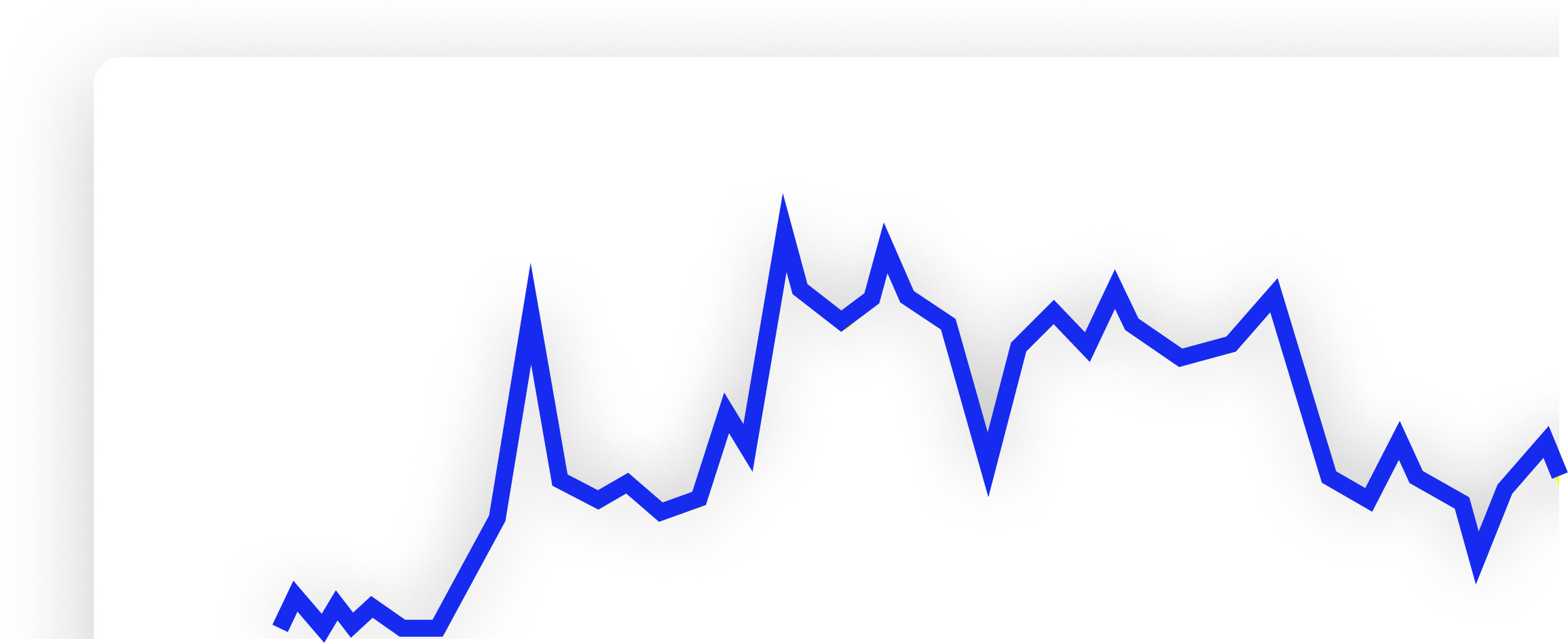

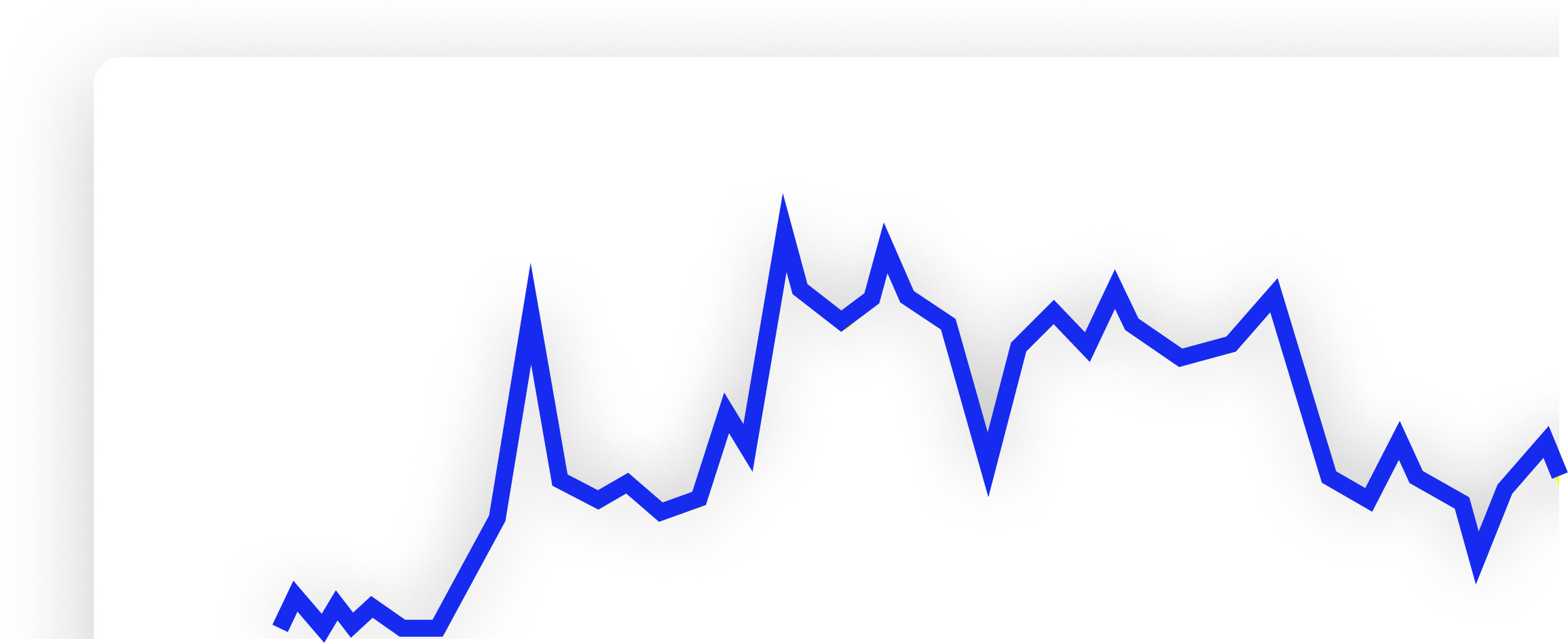

Monitor your remittance flow and growth trends.

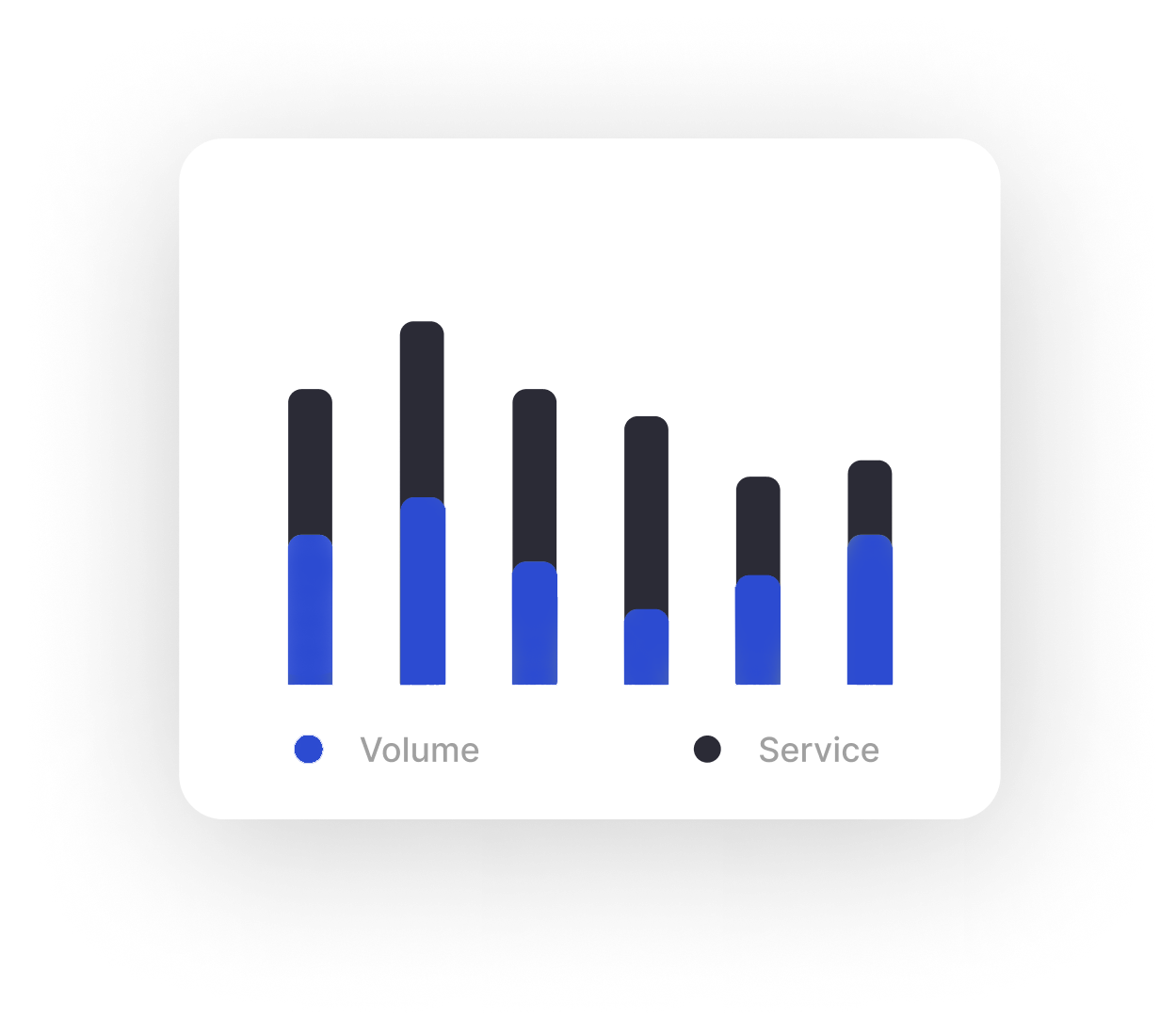

Understand client behaviors to enhance services.

Empower your Financial operations with real-time visibility.