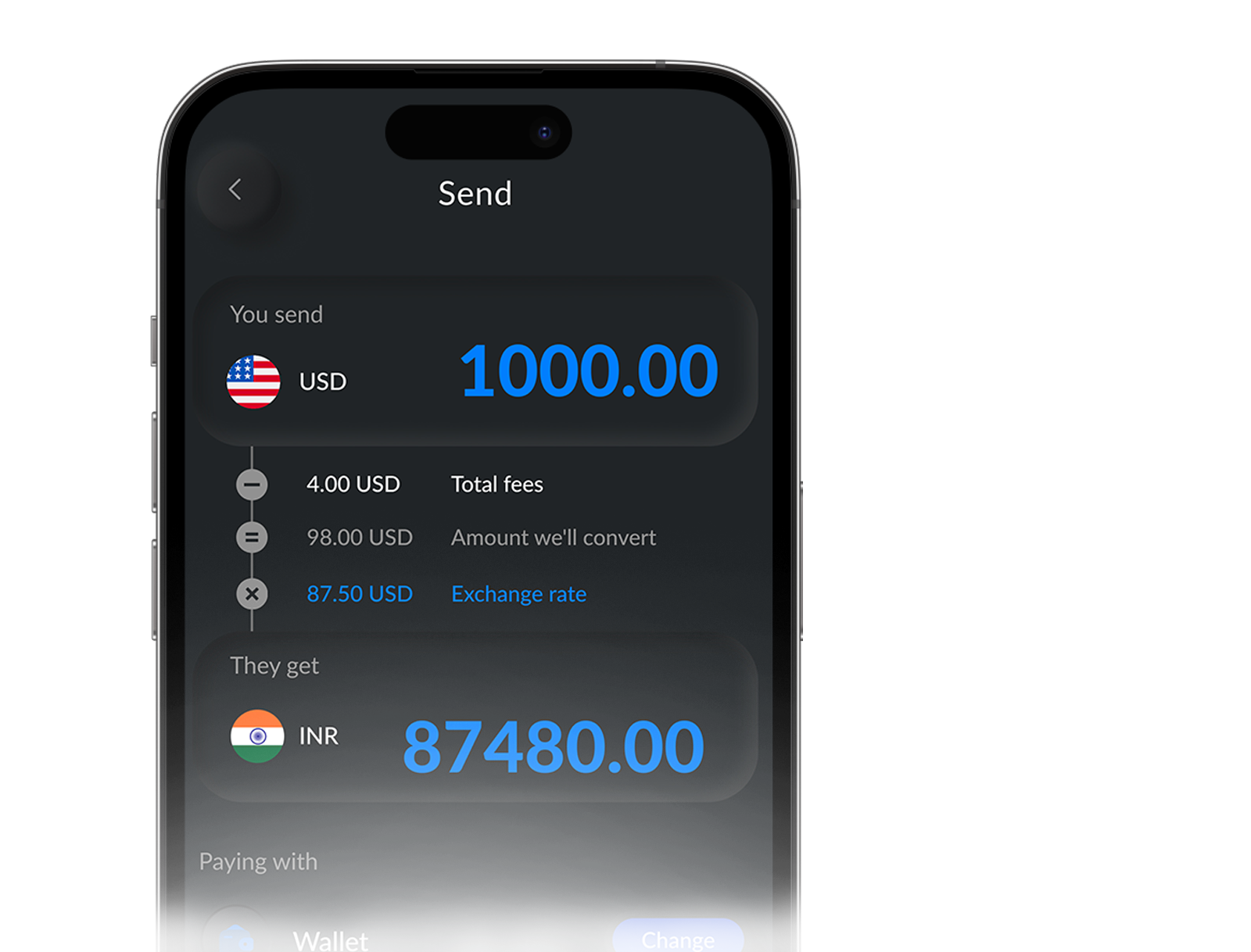

RemiGlobe – Cross‑Border Remittance Engine

RemiGlobe manages corridor routing, FX rate optimization, margin control, and settlement automation. It connects banks, MTOs, and payout partners globally to support compliant and cost‑effective remittances.

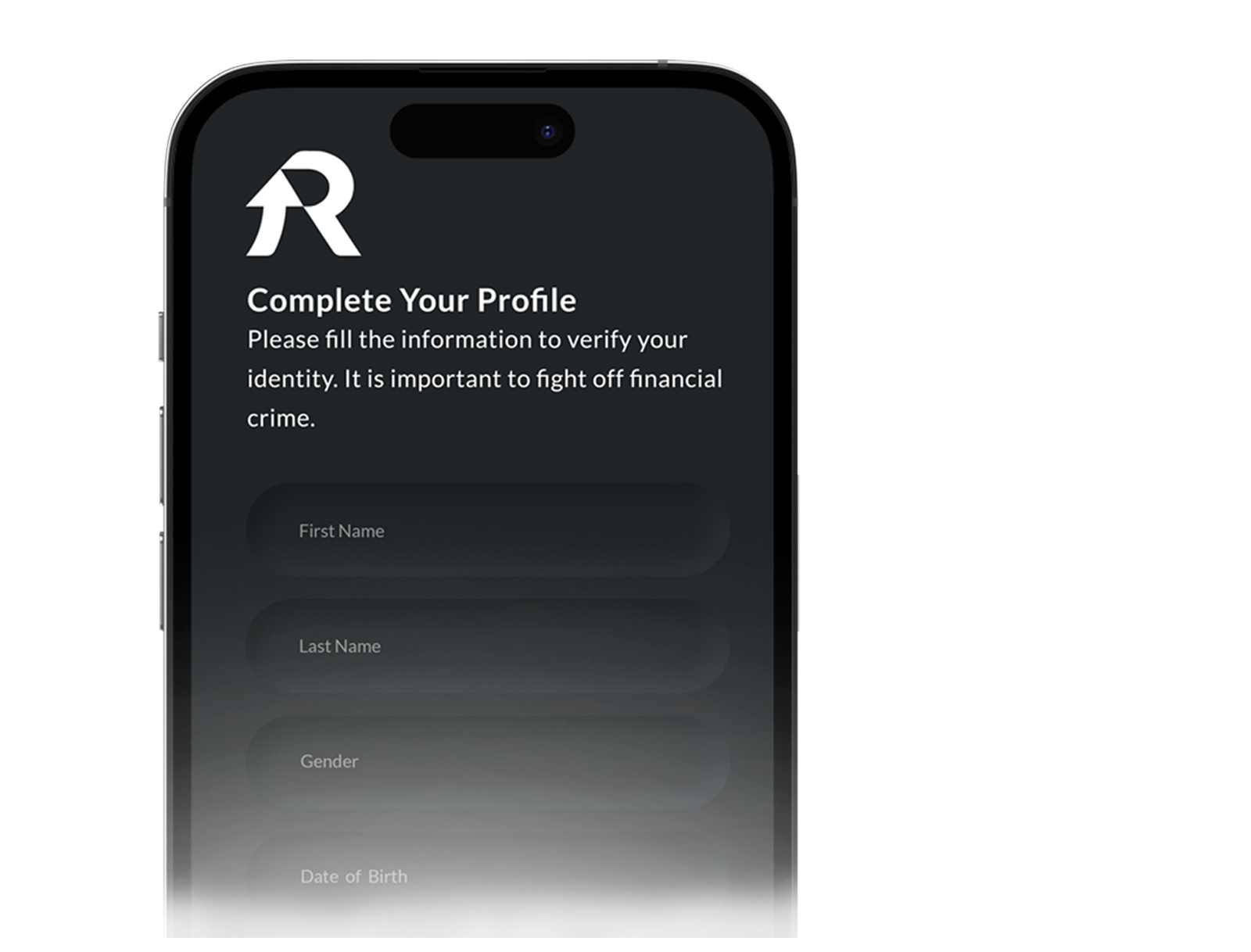

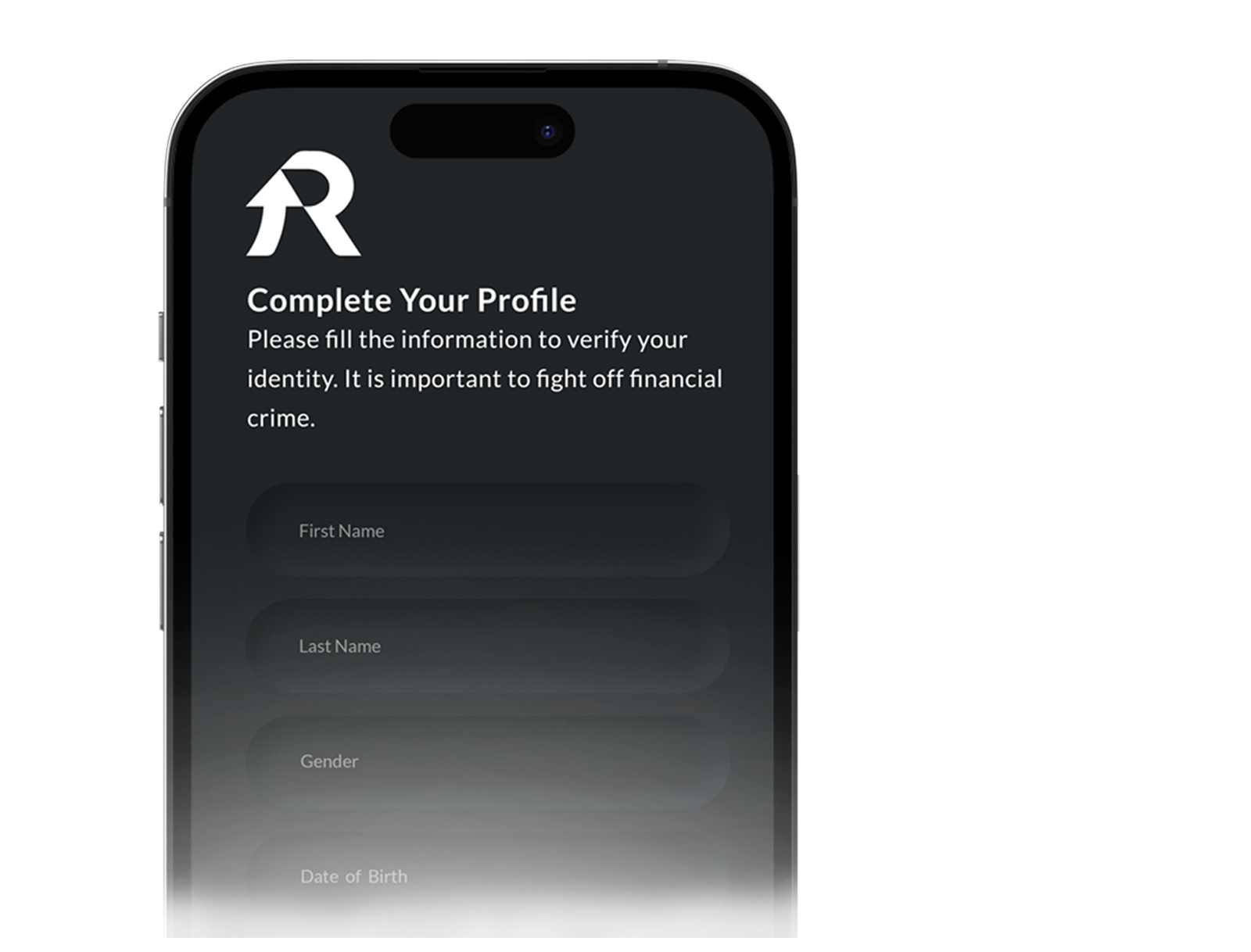

RemiVerify – e‑KYC Identity Platform

RemiVerify enables real‑time digital onboarding using document verification, biometric validation, OCR extraction, and video KYC. It supports multi‑jurisdictional ID checks and integrates seamlessly with AML and sanctions screening.

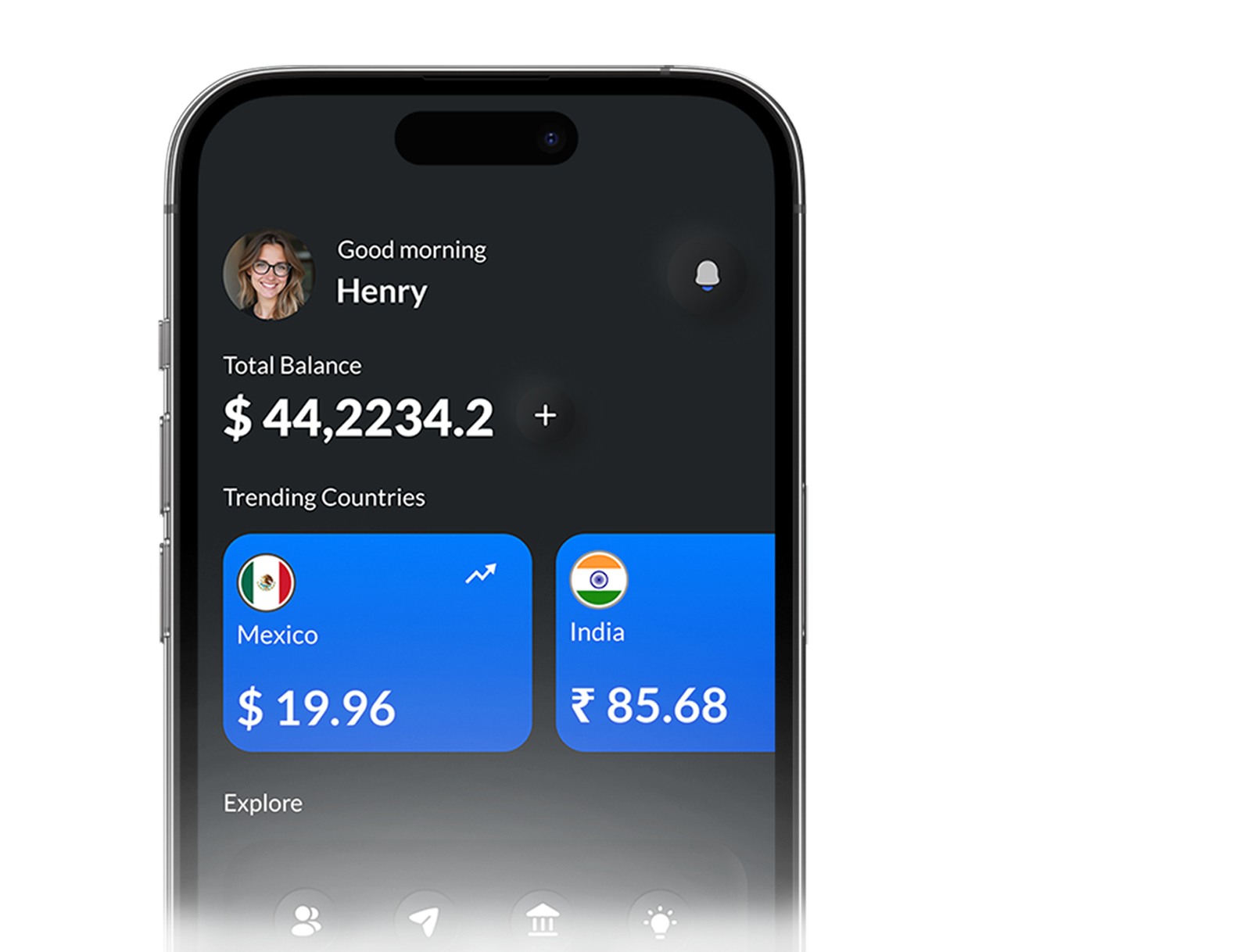

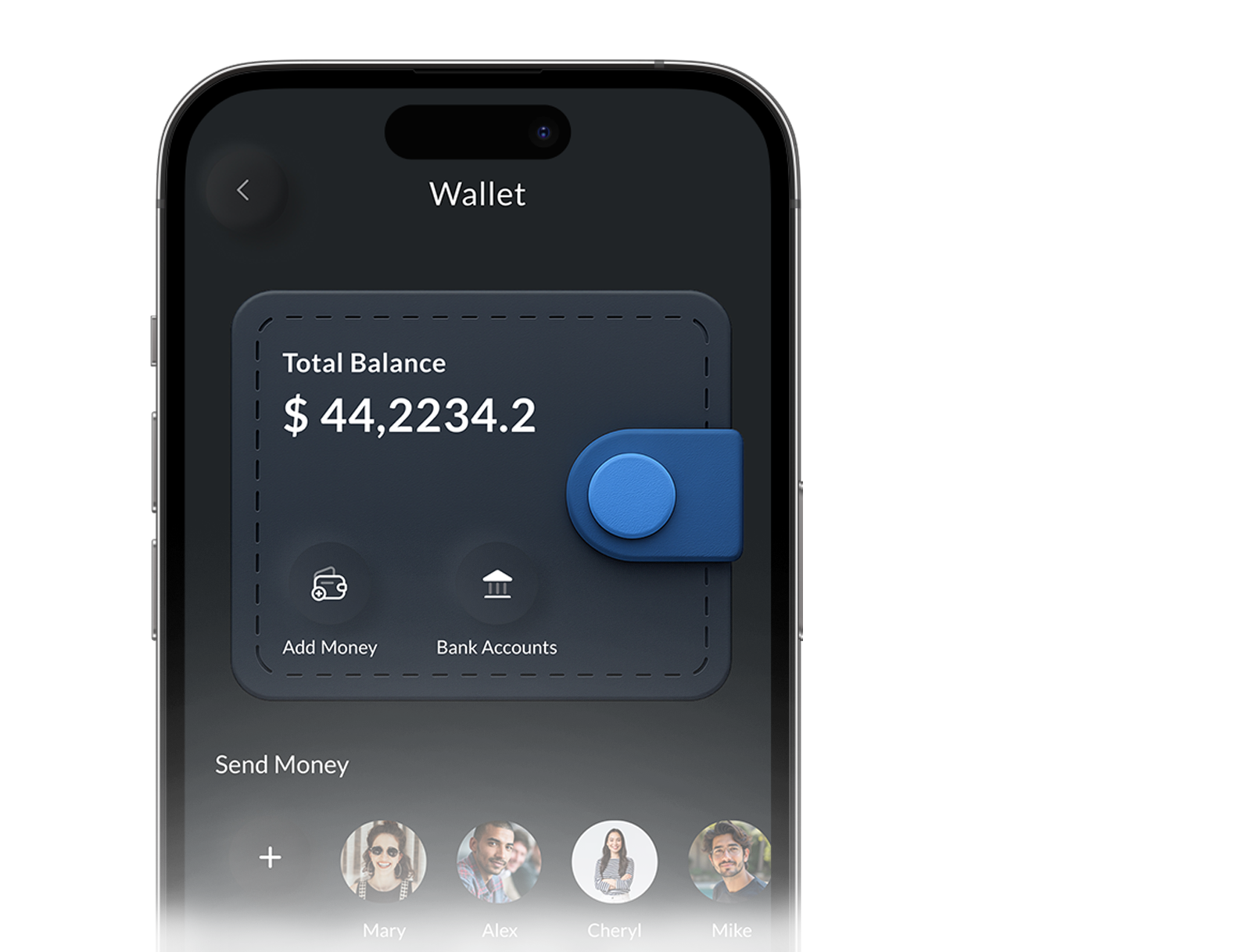

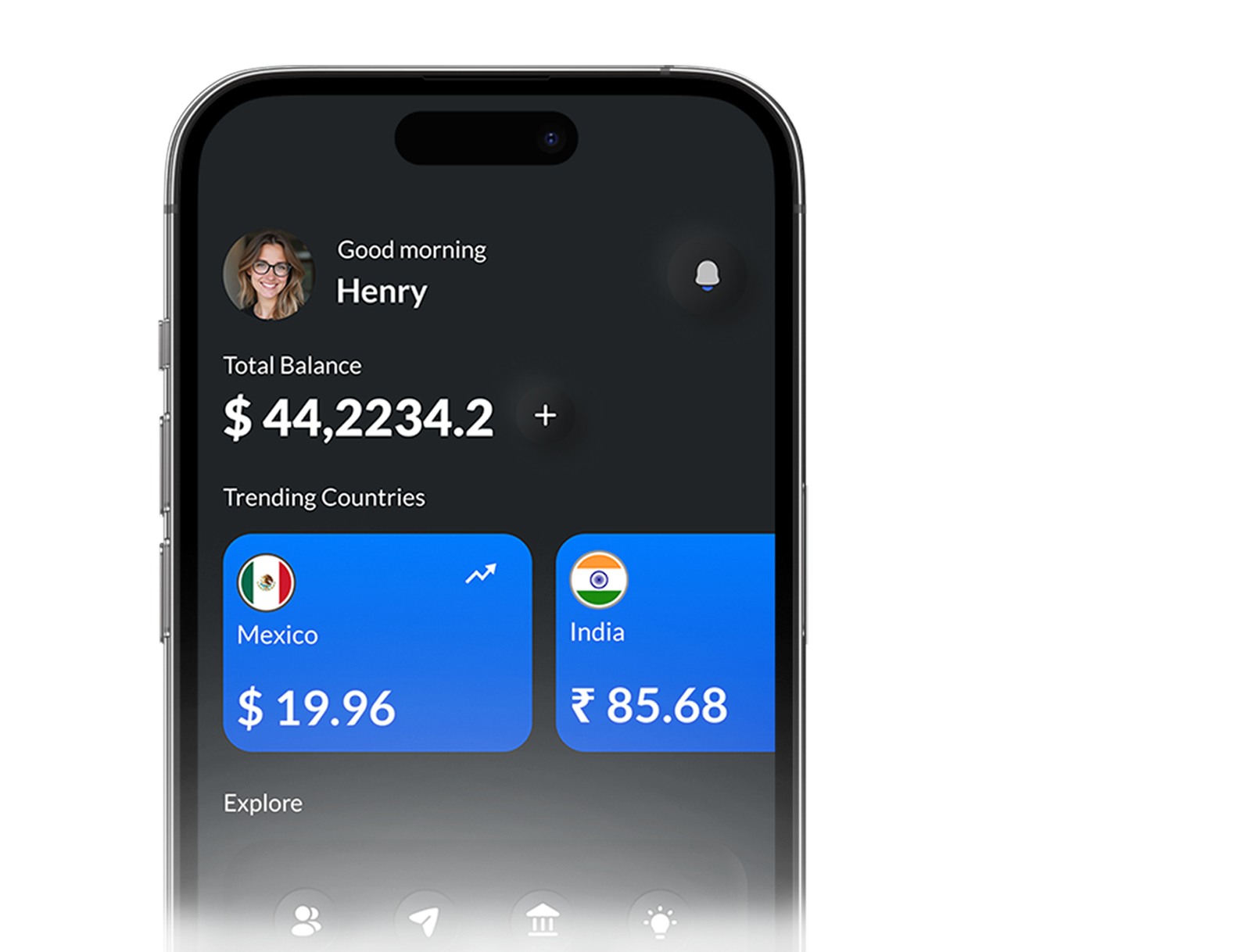

RemiVault – Multi‑Currency Wallet Platform

RemiVault delivers secure wallet management across multiple currencies with double‑entry ledgering, limits, fund holds, and instant reconciliation. Designed for scalability, it supports P2P, P2B, and B2B flows.

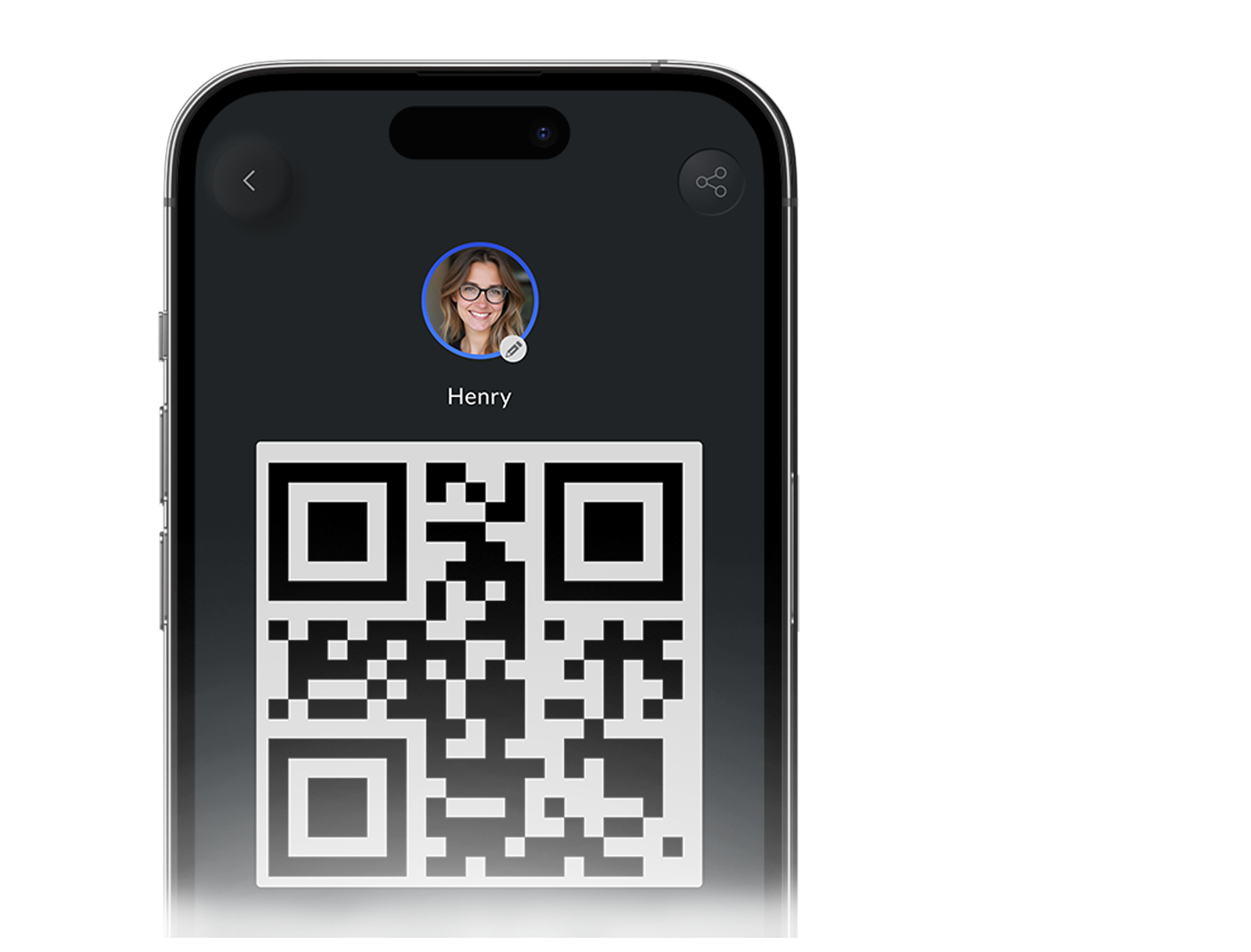

RemiPay – Merchant & QR Payment Platform

RemiPay enables dynamic and static QR payments, merchant onboarding, and wallet‑to‑merchant settlements with real‑time confirmations. Ideal for retail ecosystems and digital commerce integrations.

RemiCard – Virtual & Prepaid Card Management

RemiCard issues and manages virtual or physical prepaid cards linked to wallets. It supports card‑to‑wallet transfers, spending controls, and real‑time transaction alerts.

RemiShield – AML, Sanctions & OFAC Engine

RemiShield provides real‑time transaction monitoring, sanctions screening, and OFAC list management. It automatically flags high‑risk users, performs PEP screening, and generates audit‑ready compliance reports.

Compliance Dashboard – Risk & Reconciliation Center

The Compliance Dashboard provides unified monitoring for KYC, AML, and transaction alerts. Users can view case histories, export audit logs, and manage risk scoring through customizable parameters.